What's new in YourTradebase?

Tax Guide for Service Businesses

9 May 2016

Tax is a small but frightening word. It can seem like a minefield understanding and negotiating what you owe. After all, unless you’re an accountant, this is probably not the reason you started your business.

However, understanding what taxes services businesses are liable to pay, and how you go about doing it, doesn’t have to be hard. As the slogan goes: tax doesn’t have to be taxing.

Here’s a look at exactly what taxes service businesses need to pay and everything else you need to know about taxation.

![]()

Which taxes do I need to pay?

It all depends on what kind of business you run and how big it is. The below taxes may or may not apply depending on your status.

Income Tax

If you’re registered as a sole trader (which means you work for yourself and not anybody else) then you need to pay your taxes personally each year on your income. There are two ways to submit your returns:

- Via a paper return, which must be returned complete by midnight 31st October

- Register online and complete by midnight 31st January

The tax year runs from 6th April until 5th April the following year, and you pay tax depending on how much you earn in this period. There is a lower threshold for tax payments above which the standard rate is 20%. This increases at various other thresholds of income.

Don’t forget your expenses

If you are self-employed, your business will have running costs. Some or all of these can be deducted from your taxable profit – providing they are allowable. For example, if you turn over £50,000 and claim £8,000 in allowable expenses, you will only be eligible to pay tax on the remaining £42,000.

Expenses do not include money taken from the business to pay for private purchases. But do include things like:

- Office costs

- Travel costs

- Clothing costs (for example, uniforms)

- Staff costs

- Stock

- Financial costs

- Advertising

Cash basis

This is a way to work out your income and expenses for self-employed and sole traders that may suit you better than the traditional accounting outlined above. Using cash basis payments, you only declare money when it comes in and out of the business. This means you won’t need to pay income tax on money you didn’t receive in your accounting period.

PAYE

If you have employees, you need to register with HMRC for the Pay As You Earn scheme (PAYE) which takes tax from their income as they earn. As a sole trader you are not affected by PAYE but if you register as limited company and take a salary from the business, then you will be eligible to pay.

All taxable information is relayed to the HMRC in real time rather than at the end of the tax year.

National Insurance (NI)

These are the contributions you make to state pensions, statutory sick pay and healthcare. There are two main types of NI, Class 2 and Class 4. What you pay will depend on what you earn. NI can be paid monthly via direct debit or at the end of each tax year when you complete your return.

Corporation Tax

This is a tax levied on limited companies’ taxable income or profits. Companies are responsible to calculate their own liabilities and pay HMRC without prior assessment.

In most cases this tax only applies to larger limited companies and is not applicable to sole traders. The threshold for corporation tax is on profits of more than £1.5 million and is taxed at 20%, although this will drop to 17% from 2020.

You may be required to submit a company tax return, even if you have made a loss. When you file this return, you need to work out your profit and loss and your corporation tax bill. This is usually done by an accountant. You may be able to file accounts with Companies House at the same time (if you’re a registered company). Deadlines do apply.

Value added tax (VAT)

Technically the tax on final consumption of certain goods and services but collected at every stage of production. The standard rate of VAT is 20% but only applies to companies with taxable supplies of more than £83,000 a year.

Should I be VAT registered?

If your company has exceeded the VAT threshold for the tax year, then you need to register for VAT with HMRC. The £83,000 value relates to turnover and not just the profit at the end of the year. Once you are VAT registered, you should submit your VAT return online and settle any outstanding tax. Once registered, you can then request customers to pay the VAT when you supply goods or services.

Within the wider VAT rules, some small businesses may be better off operating within the flat rate VAT scheme, which involves paying a fixed percentage on your gross turnover each year.

Capital Gains Tax

If you sell or in any other way dispose of all or part of a business asset, then you may have to pay capital gains tax. These assets can include:

- Land and buildings

- Fixtures and fittings

- Plants and machinery

- Shares

- Trademarks

- Business reputation

Capital gains tax is paid by sole traders and self-employed people. Organisations like limited companies pay corporation tax on sales or the above assets. Remember that you don’t have to pay tax on gifts to your husband or wife, civil partner or to charity.

Capital allowances

You can claim these in the form of tax incentives or breaks when you buy an item that will be used by the business. This can include:

- Equipment

- Machinery

- Business vehicles

Deduct the value of these items from your profits before you pay tax.

Remember that you may have to pay tax on capital allowances claimed if you sell or otherwise dispose of the item in the future. You will do this in the tax period when you sell said item.

Other business taxes

Depending on the nature of your business, you may be eligible to pay a range of other taxes. These can include but are not limited to:

- Alcohol duties – if you are moving alcohol into the UK or storing it here

- Air passenger duty – for aviation businesses

- Climate change levy – for businesses that can be harmful to the environment or have been found to be polluting

- Landfill tax – companies that need to dispose of large amounts of waste products may be required to pay an additional tax

- Tobacco products duty – if your business imports tobacco products then you have to pay an import duty

Charity status

If you are a charity recognised by HMRC, then you are eligible for certain tax reliefs. You won’t pay tax on most kinds of income (as long as it’s used for charitable purposes) and can claim back tax that has been paid on any income.

Appealing your tax and non-payment

If you wish to challenge decisions made about your income tax, PAYE, capital gains or other, you can appeal to the First Tier Tribunal. This is a body independent of the government and will listen to both sides of the argument before reaching its decision.

If you simply can’t pay your tax then you need to make a hardship application which will be reviewed.

Tips for making taxes easier

The thought of tax is almost always more scary than the reality. Once you actually get on and do it, it’s not so bad. Especially if you complete your return online. However, there are some things you can do to make paying your taxes each year that little bit easier. These include:

![]()

Start early

Leave it to the last minute and you’re asking for trouble. You should start to complete your return at least eight weeks before the deadline. This gives you plenty of time to locate all the information you need.

If you miss the deadline, you could face a fine. This will be £100 initially, followed by £300 for failure to complete after 90 days. From then you’ll be required to pay £10 a day interest up to £900. The fines continue to rack up and you could even be charged the full tax amount as a fine in exceptional circumstances.

Keep regular records

Update your income and outgoings every month, with a separate bank account for your company. Doing things little and often will really speed up the tax return process.

![]()

File it away

Keeping all your receipts neatly stored and filed in the correct place is definitely the way to go. This will really speed up the process when it’s time to complete your return.

Ask for help

HMRC are always available to ask for advice. You can find out more at https://www.gov.uk/ or you can also contact them via Telephone: 0300 200 3300, Textphone: 0300 200 3319, Outside UK: +44 135 535 9022.

There are also plenty of tax accountants who can help you with tax and returns. Ask around for recommendations.

![]()

Paying your tax bill

There are a number of ways you can pay your tax bill. As mentioned above, if you’re PAYE you will be paying your tax in real time as part of your salary. However, sole traders and self-employed people will need to pay once they have calculated their income. This can be done either by bank transfer, direct payment or you can spread the cost using a direct debit.

You may also have to make payments on account, which means you pay a portion of the following tax year up front.

What should your terms and conditions include?

27 January 2016

Terms and conditions. The fine print. For most people, they’re skipped over and ignored… so, why should your business have them and what should your terms include?

Essentially, terms and conditions are rules a customer must agree to abide by in order to use a service. They set out what is expected of both the customer buying the service and of the service business providing the service.

Generally provided at the time a quote is submitted – or just before work starts on a new job – terms are in important part of completing work for your customers, but why should your business be using them and what should they include?

Why are clear terms important?

Terms set out the conditions and expectations of the service business and of the customer, and so are an important piece of communication for completing work.

Emma jones from Enterprise Nation agrees on the importance of businesses providing terms:

“Terms and conditions certainly have an important role to play when it comes to customers and suppliers understanding their duties, rights, roles and responsibilities.”

By setting out clear expectations for the work you’re about to complete, both your business and your customers can benefit in the following ways:

Peace of mind. Dotting i’s and crossing t’s give both you and your customer peace of mind that everything is ‘on the table’ and clear. Peace of mind comes from knowing that everything has been agreed before any work starts.

Trust and credibility. Setting out terms before work starts builds your customers trust and improves your credibility – with important work criteria clear and upfront, your customer knows exactly what they’re getting into, and what they can expect from you.

Avoid disputes. Despite your best efforts, disputes can arise during the course of completing work. These disputes are often caused by uncertainty about what’s expected. Terms will help both you and your customer understand expectations, and so will often mean disputes are avoided before they arise. When disputes do occur, clear terms can quickly settle the dispute if they’ve addressed what happens in the case of a dispute.

Professional image. As well as the practical benefits for setting out your terms, your business can benefit from the professional image you portray by supplying terms. It can act as strong evidence that you know your business, and are clear about what it means to work with your business.

Having clear terms agreed with your customer for all service work you’re completing helps avoid headaches once work starts.

When to include terms and conditions?

Providing your customers with terms and conditions that are 6 pages long, full of legal speak and tiny fonts can undermine the confidence your customers might have in your business. Try and keep your terms short, concise and easy to understand to get the most from them.

So, should terms be included with every piece of work?

Regardless of the size of the work you’re completing for your customers, the benefits from providing terms and conditions remain the same. In fact, advice from the Homeowners Alliance to homeowners suggests always seeking written terms before agreeing to work:

Undertaking building work in the absence of [terms] leaves homeowners and builders at risk because there isn’t a formal agreement around what is in and out of scope, how payments will be made, completion dates, whether the correct insurance has been taken out and so on.

Making sure your customers understand what’s included in your terms helps build trust and confidence – offer your customers the chance to ask questions or ask for clarification on anything they don’t understand.

Even if your terms are lengthy, providing a summary of the key points from your terms – such as expected payment schedule, the customers right to cancel, and how long the quote is valid for can be enough when you’re quoting for work.

Include terms for every job you complete – either as part of your quotation or as a document in their own right.

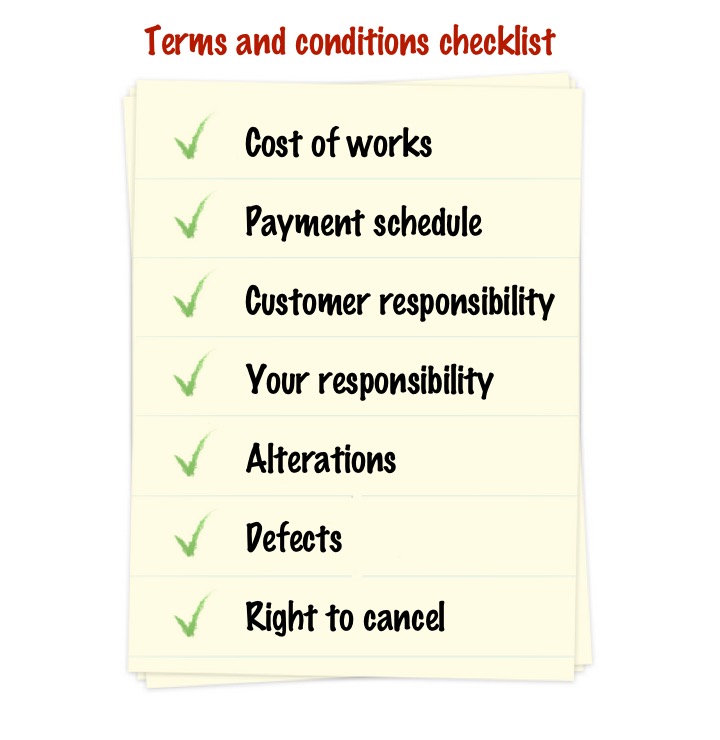

What to include – a checklist for your Ts & Cs

We know terms are important, can protect your service business – and your customer – but what should you include in your terms?

Here are our suggestions on what you should consider including in your terms:

The cost of works. As obvious as it sounds, ensuring the complete cost of works is agreed between both parties is essential. Your terms could reference your written quotation, and confirm the total amount quoted is the complete cost of the work. If you’re estimating the cost of work, ensure you identify how you will agree additional costs with your customers before they incur them.

The cost of works. As obvious as it sounds, ensuring the complete cost of works is agreed between both parties is essential. Your terms could reference your written quotation, and confirm the total amount quoted is the complete cost of the work. If you’re estimating the cost of work, ensure you identify how you will agree additional costs with your customers before they incur them.

The payment schedule. Agree when payment – or part-payments – become due. Will you be meeting the cost for all materials up front? Do you require a deposit payment? When and how should any outstanding amount be paid? By agreeing payment terms and a schedule for payments before work starts, you help avoid disputes and unexpected invoices during work.

The payment schedule. Agree when payment – or part-payments – become due. Will you be meeting the cost for all materials up front? Do you require a deposit payment? When and how should any outstanding amount be paid? By agreeing payment terms and a schedule for payments before work starts, you help avoid disputes and unexpected invoices during work.

Your customer’s responsibilities. Do you require access to the property between particular hours of the day? Do you require facilities – water, electricity, toilets, etc – to be available to you at all times you’re in the property? Are your tools to be stored securely on the property? If heavy objects need to be moved prior to the job, will this be your responsibility or your customers? Being clear on the responsibilities your customers have can reduce the likelihood of nasty surprises later on.

Your customer’s responsibilities. Do you require access to the property between particular hours of the day? Do you require facilities – water, electricity, toilets, etc – to be available to you at all times you’re in the property? Are your tools to be stored securely on the property? If heavy objects need to be moved prior to the job, will this be your responsibility or your customers? Being clear on the responsibilities your customers have can reduce the likelihood of nasty surprises later on.

Your responsibilities. Of course this is a two-way street; you have responsibilities to your customer, too. Are you responsible for clearing up at the end of the job, or at the end of each working day? What happens if you aren’t able to provide work on an agreed date? Will you be using sub-contractors during the job? Agreeing on your responsibilities will help both your service business and the customer know exactly what is expected before work starts.

Your responsibilities. Of course this is a two-way street; you have responsibilities to your customer, too. Are you responsible for clearing up at the end of the job, or at the end of each working day? What happens if you aren’t able to provide work on an agreed date? Will you be using sub-contractors during the job? Agreeing on your responsibilities will help both your service business and the customer know exactly what is expected before work starts.

Alterations. If a situation arises that changes the original terms or description of works, make sure to confirm this in writing and get signatures if you can. By keeping a copy of the agreed amendments along with the original contract, you can refer back to this should any dispute arise. Stipulating this condition within your terms keeps things clear and sets out a process for both parties agreeing to changes to the scope of work.

Alterations. If a situation arises that changes the original terms or description of works, make sure to confirm this in writing and get signatures if you can. By keeping a copy of the agreed amendments along with the original contract, you can refer back to this should any dispute arise. Stipulating this condition within your terms keeps things clear and sets out a process for both parties agreeing to changes to the scope of work.

Defects. If you offer guarantees on your work and/or materials, be sure to include this within your terms. If you don’t, you should consider stipulating which defects you would return to fix – and whether there’s a cost for those remedial works. You should also agree on an appropriate length of time for this offer to stand.

Defects. If you offer guarantees on your work and/or materials, be sure to include this within your terms. If you don’t, you should consider stipulating which defects you would return to fix – and whether there’s a cost for those remedial works. You should also agree on an appropriate length of time for this offer to stand.

Right to cancel. What are the timings of the agreement and what notice is required to get out of it? Specifying what happens if either party doesn’t deliver or pay or wants to end the relationship – and what costs the customer would still be liable for – can help avoid disputes and give a clear process for handling work cancellation.

Right to cancel. What are the timings of the agreement and what notice is required to get out of it? Specifying what happens if either party doesn’t deliver or pay or wants to end the relationship – and what costs the customer would still be liable for – can help avoid disputes and give a clear process for handling work cancellation.

Late payment penalties. If you do not specify a late payment so in your terms, you have no right to charge interest for late payment, so you could be out of pocket if a customer pays late.

Late payment penalties. If you do not specify a late payment so in your terms, you have no right to charge interest for late payment, so you could be out of pocket if a customer pays late.

How to get your own terms and conditions

There are several ways you could get terms drafted for your service business:

Trade associations and organisations. Do you belong to a trade organisation? Check with them if they provide professional, legal template terms that you can use. Trade associations often provide free templates for their members, and these have usually been drafted in conjunction with suitable legal advice.

Hire a solicitor. If the terms of service for your business are unique, you might find a template doesn’t quite cover what you want to include. Hiring a qualified solicitor to complete your terms might be the best option. Start by pulling the terms from a template that are suitable, and then add your own conditions – it’ll be cheaper for them to re-draft something you give them than for them to produce terms from scratch. Whilst an expensive option, having a legal professional draft your terms could save you a huge amount of money should a dispute arise.

Online term templates. Free or cheap templates for terms and conditions are readily available online. Should you decide to use template terms, ensure they include all the details you want to convey to your customer. In order to be confident they protect your business (and your customer) adequately, it’s recommended you ask a legal professional to check over the terms and make sure they are legally sound.

If you’re unsure on the validity of your business terms, always seek advice from a legal consultant who can make sure your business is properly protected.

What now?…

If you’ve got terms for your business, take a few minutes and re-read them to make sure what you’re asking your customer to agree to is still up-to-date and relevant for your business today.

If you have terms and don’t supply every customer with a copy, make sure to include terms with every quote or at the start of every job. If your service business uses YourTradebase then you can add your terms to your quote or job confirmation templates easily – this ensures they’re always sent to your customers when you quote or start a new job. (More info on email templates in YourTradebase can be found here.)

If you don’t have any terms for your business, then you’re probably not protecting yourself or your customer. You’re probably also losing some customer trust – so make providing your terms and conditions an everyday part of working with your service business.

How To Turn Your Quotes Into Business

20 January 2016

Sending out a quote is an investment of your time. How can you stack the odds of winning in your favour, and make sure your investment has the best chance of paying off?

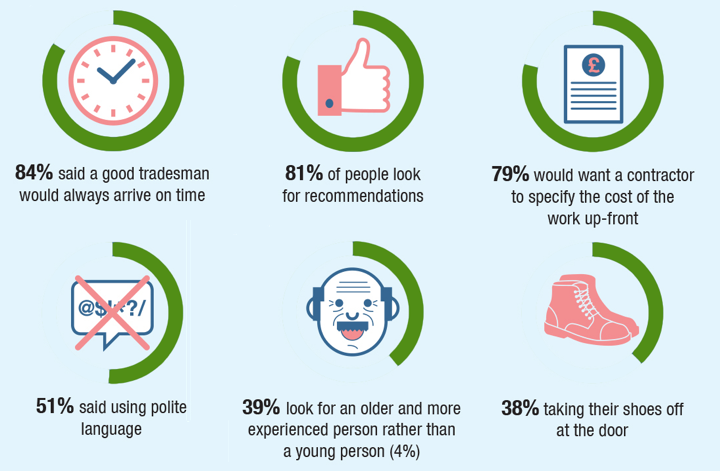

A 2015 survey from The HomeOwners Alliance and TrustMark shines a bight light on what customers do – and don’t – look for when deciding which tradesmen to choose for work.

What can you learn from what customers look for, and how can you apply it to your quoting process to turn more of them into new business?

What % of your quotes = new business?

There’s a classic business saying credited to Peter Drucker, a management consultant, that goes:

“You can’t improve what you don’t measure”.

The idea is simple; if you want to improve something, you have to be measuring it.

Why does measurement lead to improvement? Partly because of something called the ‘Hawthorne Effect‘.

Coined in 1958 by Henry A. Landsberger, the Hawthorne Effect describes how people improve an aspect of their behaviour in response to the fact that measurement is taking place.

Think about it for just a second. Measuring something = you’re more likely to improve it.

When you start measuring thing, positive things happen:

- You can set yourself goals

- You can see the progress made.

- You can identify what needs to be refined for better results.

Want to improve your quote success rate? Start by measuring how many quotes you win: improvement (from behaviour change) will follow.

Know your quote hit rate

As a guide, we looked at 4,000 service businesses who use YourTradebase to create their quotes and found that 66% – or 2 out of 3 quotes – are accepted by the customer and result in jobs.

What’s your quote success rate?

It’s simple: keep track up the number of quotes you send out each month and how many jobs you win from them.

To calculate your quote win rate: (Number of jobs won / Number of quotes sent) * 100

That’s your quote win rate, and it’s what you’ll be measuring to improve how many quotes you win.

What DO customers look for in their quotes?

To start improving your hit rate, you need to know what impacts a customers decision to choose one tradesman or service business over another.

Here’s what The HomeOwners Alliance found when they surveyed homeowners in the UK:

- 84% look for service businesses that turn up on time

- 81% look for recommendations from others

- 79% want to see clear costs up front

- 59% want to see a polite and friendly person

- 39% look for experience

- 38% look for taking off shoes at their front door!

…And what DON’T customers care about?

- Only 14% want to see impressive tools

- Only 13% want to see snazzy business cards

- Only 12% want to see branded clothes

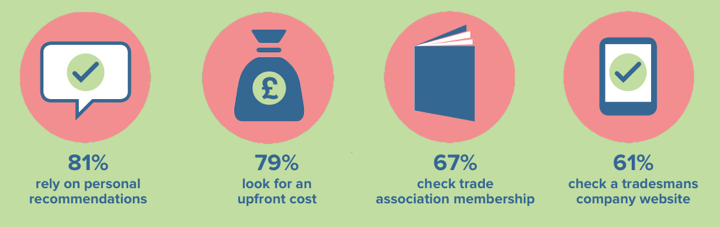

What DO customers check when choosing a quote?

They’ve met with a tradesperson, but what do customers check for when deciding between different quotes?

- 81% check for personal recommendations

- 79% check that all costs have been identified up front

- 67% check membership with a trades association

- 61% check a businesses website

What’s missing from this list? Well, It seems price isn’t a major consideration for customers choosing between different quotes.

Customers generally don’t choose a quote based purely on cost. Trust and transparency seem to be much more valued that the price of the work.

Stack the odds in your favour: Tips for converting more quotes into new business

So now you know what customers do and don’t look for when choosing between quotes and service businesses.

How do you put this all together and start improving your chances of winning new work?

Consider how a customer chooses which quote to accept: how many of these things do you do – or provide – to your customers when you quote for new business? Which of these things can you easily start doing to increase your odds?

From what we’ve learned about the customer decision making process, here are our top suggestions for increasing your quote win rate:

1. Provide testimonials and references

With 81% of customer relying on personal recommendations to choose a quote, including testimonials and previous work when submitting a quote is very likely to increase your odds of winning the work.

You might not have been personally referred to your potential new customer, but you’ve got happy customers – so make them count! Collecting and using customer testimonials and references could well be a shortcut to more work.

Include a sheet of references and, where possible, include any customers that are happy to be contacted about the quality and professionalism of your previous work.

Further reading: How to gather and use testimonials effectively.

2. Get your quotes completed quickly

Customers value their time, and with 84% looking for service businesses to turn up on time and when they said they would, you should respect their time too.

Customers value their time, and with 84% looking for service businesses to turn up on time and when they said they would, you should respect their time too.

We also know that 83% of customers get frustrated by the time it takes to receive a quote once a tradesman has visited.

So with speed being a big factor for so many of your potential customers, it pays to get this right. Make sure you’re clear about when you’ll turn up to survey or discuss new work – give a time range if you can’t be clear and call to confirm an exact time as close to your time slot as you can – and make sure you’re there on time!

If you’re running late for a scheduled visit, be sure to let your customers now. You want to show them that you respect their time.

Once you’ve visited them… the clock is ticking! Let your customer know when to expect your quote or estimate, and then make sure you deliver on time. There are lots of ways you can speed up your quoting process, and using estimating software can be a great way you setup to turn quotes around quickly.

Further reading: How quicker quoting wins you more work

3. Produce professional quotes and be clear on costing

79% of customers want to see clear costing when receiving costs. We all hate hidden prices or confusing costings structures. Make sure your customers are crystal clear on what you’re providing and what it’s going to cost them to avoid any confusion.

79% of customers want to see clear costing when receiving costs. We all hate hidden prices or confusing costings structures. Make sure your customers are crystal clear on what you’re providing and what it’s going to cost them to avoid any confusion.

Providing clear costings and descriptions of the work you’re quoting for also ensures you avoid any conflict further down the road, should you win the work.

Clear costing and concise descriptions of the work you’re going to carry out builds trust, transparency and confidence. Using software for job management like YourTradebase could also help by providing you easy tools to create professional quotes and ensuring you get the details right 🙂

Further reading: How to write a winning quote

4. Make sure the details are clear

As well as clear costing, be clear about your terms.

We know customers value confidence above low cost, so the devil will be in the details of your quote. Making sure your terms and conditions are clear, plain and simple to understand will help to build trust with your customer.

Include within your terms how long your quote is valid for, your required payment structure and any insurances or warranties that you have.

If there are optional extras that your customer might want to choose from, make sure they’re clearly marked and explained on your quote, and offer a follow-up call with your customer so you can review the options together and you can answer any questions they might have.

5. Highlight any trade association memberships and guarantees

Lastly, we know that 67% of your customers will check to see if you have any trade accreditations or belong to any trade organisations.

Lastly, we know that 67% of your customers will check to see if you have any trade accreditations or belong to any trade organisations.

But, don’t rely on them checking – provide these trust credentials upfront and centre within your quote.

Highlight any trade associations you have a membership with, any accreditations your service business holds, and any guarantees that are applicable.

Including these details help put your customers mind at rest and tips the odds of winning the work in your favour.

Checklist for increasing your quote win rate

You spend a lot of time quoting to try and win new work. Making some small changes could make a huge difference to your business.

Want to win more work in 2016?

13 January 2016

New Year, new business opportunities. Whatever your business resolutions for 2016, winning more work is likely high on your list. Here are our tips for increasing your leads and winning more work in 2016.

So, we’ve all survived Christmas for another year (hic) and are raring to go! Let’s ease ourselves in gently though shall we? We’ve compiled some straight-forward tactics that are easy to implement within your working week but that will help you grow your business.

Small steps to big success in 2016

Success is the sum of small efforts, repeated day in and day out.

Big success doesn’t always come from big changes. Taking small, manageable, repeatable steps towards working smarter can lead to less admin, freeing you up to make sure your doing great work instead of admin.

Here are some small steps you could take towards big success in 2016:

Save yourself some of the time you spend on paperwork

Drowning in paperwork when you could be out securing leads, quoting for business or completing a job is not good for you or your business, and any time you can save on paperwork means more time spent on winning actual work.

So, how do you spend less time on paperwork without compromising quality? Using the right quoting software could be the perfect start…

Well, let’s say you spend on average two hours a week completing paperwork. That’s eight hours a month, or the equivalent of an entire day a month spent on admin.

Imagine claiming half a day a month back – what would you do with the extra time? You could fit in another job of course…or perhaps take the afternoon off and spend it with your family.

Whether you’re providing a customer quote or sending out an invoice, tackling paperwork efficiently will help you significantly reduce the amount of time you spend on your paperwork. Buy a folder for each of your jobs. This is a physical folder (nothing fancy, a paper or plastic file will do) where you put all the information you have on that job. That way everything you need is in one place and so can be easily found when you need it. No more scrabbling down the back of the sofa or car seat searching for those notes you took on site. This is also especially helpful at the end of the year when you have to find that last receipt the taxman is asking for.

If paperwork is preventing your business from growing, try some simple processes to make paperwork easier.

Cut out duplication with templates

These take a little time to get together but, once they’re set up, you’ll wonder how you managed without them.

Setting them up for your invoices, quotes and estimates is one of the easiest ways to save time. You can easily do this in Word (or any of the Microsoft packages) by saving it into Word itself (via ‘adding’ a new template), but you can always just save it as a file on your computer or laptop, too.

Then all you need to do is fire up the relevant quote template, drop in the info, save, and you’re done.

Pretty simple, right?

Organise your working week

To avoid things getting messy as you jump around from quotes to invoices, and back to estimates, why not choose specific days of the week for each task?

This may not always be possible but, by setting yourself a schedule, you’ll find it much easier to manage. You’ll know that, on a Tuesday, it’s invoice day and you can concentrate on sorting them.

You’d be surprised how much this focus can help you shave off time spent on paperwork.

Here’s where a good job management software tool can really help.

Make a list

This is a really simple one but can be easy to forget. If you often notice you’ve missed out vital information on paperwork (and then have to go back in and amend it) then you need a check list!

Get the basics down for each piece of paperwork; what they definitely need, what they should need, and what you want them to need.

Stick this somewhere you can see it (above your desk/kitchen table/tool shed) to remind yourself.

Daily Tasks

We all need to grow up about this; there are set tasks we should do every day in order to make our lives easier and our working day more productive.

Setting yourself daily tasks to work through helps you stay in control.

Try setting these daily tasks for yourself:

What paperwork needs my attention today?

Sort paperwork into tasks of ‘must do’ ‘can do’ and ‘can wait’ – this helps you prioritise

Is there paperwork coming up in the next few days that I can prep for to make my life easier?

How can I divide my time today to make sure all tasks get completed?

Can I delegate anything to my staff / friend / colleague / wife / partner / slave?

Do the same for your weekly plan (a list of things to achieve that week, and on which days you’ll complete the tasks) will help you save even more time.

Draw up a short list of the admin tasks you spend most time doing – then, identify one task for each that you can save yourself just a small amount time and be more efficient. Save small chunks of time now and you’ll quickly be rewarded with a lot more time to focus on your business growth.

Simple tips to increase your leads in 2016

Ensuring you have work coming in regularly is often one of the main stumbling blocks to success and many service businesses seem to be in the dark about how to pick up ‘leads’ – potential jobs – and the different channels that can help them to get work.

A successful (trades)man continues to look for work after he has found a job.

In the service business, work breeds work.

Doing a job can often be very visible, and often people will simply come up and ask you about availability. When you’re on a job, display your details somewhere visible, be friendly and try to get to know clients, neighbours, and other locals.

If you’re working on a residential property, try putting some simple letters through the door of neighbouring properties to let them know about the work you’re doing.

Get in touch with neighbouring properties. Letting neighbours know of any disruption they might face by your work builds a positive, courteous image – and gives you the chance to let property owners know what work you’re completing on their road.

Make the most of word of mouth

Building good relationships with clients and ensuring they are happy is essential to increasing your word of mouth. Keep your clients 100% happy and not only will they provide you with work for a lifetime, they’ll tell their friends and family about you, too.

There are plenty of tradespeople who find regular work for whole careers from just a small group of interlinked people. Put in the extra half a day here or there, go that extra mile to deliver the goods and the rewards are exponential.

Are you making the most of word of mouth for your service business?

Testimonials

It’s also important to (politely) ask customers for referrals (to their friends and family) and testimonials, or references, for your website and any other social media channels as these can be invaluable to your digital presence.

Put your happy customers to good use with testimonials.

Online presence

People increasingly use online sites to find reliable tradespeople, so you need an online presence. Trusted tradespeople sites are often the first port of call for anyone looking, so you need to be on these sites – and have good reviews! Sites like Checkatrade and Trustatrader can make or break your business – without sounding too dramatic about it.

Ask clients to review your work on these sites and, if there are any negative reviews, respond directly and openly (you can then hopefully turn these into positive feedback. Clever eh?).

Also make sure that any online presence that showcases your work has an easy, direct way for potential customers to get in touch with you. That might be an enquiry form on your website or on your Facebook page, or a bio with a contact number on your instagram profile. If you’re displaying the quality of your work somewhere, make sure people who might see it can get in touch with you.

Will 2016 be the year you put the web to work for your business and grow your online presence?

Networking

Networking is a bit of a dirty word and few people really enjoy doing it, yet there’s no doubt that it works. There are plenty of formal networking events you can attend to spread the word. But networking doesn’t have to be a formal affair. As we’ve mentioned above, be chatty and open, talk to people where you’re working, and you’ll get noticed.

When working on jobs in areas where you think you can target more leads, make up some leaflets and drop them through the letterboxes of neighbours. There’s a good chance they’ve seen you working and the extra push of advertising that a leaflet can give will help to get your name and number out there.

It’s also important to remember that it’s a two-way street. If you want to network efficiently, you have to be prepared to give and take. Recommend people you trust and hopefully they’ll do the same for you.

Getting accredited from the relevant bodies always helps to improve your reputation, and establishments that offer these courses and certificates are great places to meet fellow tradespeople and make contacts.

Top tips for networking successfully:

- Be pro-active about networking

- Use a rage of networking methods, from old to new

- Network with the right people

It might not be your favourite thing to do, but it gets results.

Make sure you’re making the most of any opportunities to grow your network in 2016. A great network = more work.

Hopefully this has given you some ideas on how to win more business and increase your leads in 2016. Right then, just time for another cuppa…then you can get cracking!

How to Set Up Your Own Trade Business

23 November 2015

How to Set Up Your Own Trade Business

For many people working in the trades, setting up on your own is the ultimate aim. Just imagine – no more working for grumpy foreman or bossy project managers. From now on you can deal with clients directly and get paid without a big chunk going to a middleman.

Setting up your own trade business puts you in charge of your own destiny. You call the shots, make the decisions and determine your own direction. You’re judged on the quality of work you do and reap all the rewards of your hard work.

In this guide we’ll walk you through all the things you’ll need to consider once you’ve made the decision to set up your own business. This includes:

F

|

|

|

|

|

Business Strategy why it’s important to have a plan |

Practical Considerations making sure your business is 100% legal |

Financial Matters how to look after cashflow and accounting |

Getting Regulated how to deal with the bodies that oversee your work |

|

|

|

|

|

Sourcing Materials because getting the right price affects your bottom line |

Admin Needs why organisation is key to good business |

Recruitment you’re only as good as the staff you employ |

Innovate why you should always be thinking about the future |

Going out on your own: The strategy

Starting from scratch usually means starting small. There are over three million small businesses in the UK, many of which are operating in the trades, so you need to be clear what it is that you are going to do differently.

You need to have a clear business goal and strategy in place, and back this up with a written business plan. Writing down your plan helps you to identify:

|

|

|

| What needs the business must meet | Who will be your customers | How you will make money |

|---|

You can find advice about writing your business plan here:

https://www.gov.uk/write-business-plan

Setting Up Shop: The Practicalities

When you set up on your own, it’s not quite as simple as putting an advert in the local paper and waiting for the phone to ring. There are certain legal and practical considerations that you need to adhere to.

You must register as self-employed with HM Customs and Revenue: https://www.hmrc.gov.uk

This will inform the relevant authorities that you will be paying your own tax from now and not through an employers PAYE scheme.

The page you’ll need to find is here: https://www.gov.uk/set-up-sole-trader/register

If you’re setting up a limited company then this in turn must be registered with Companies House to make it official: www.companieshouse.gov.uk.

It costs about £15 to register your company online and applications are approved within 24 hours. Or you can do it the old-fashioned way and post it, costing £40 and being approved within eight to ten days.

For more advice on what is required of you legally, you can learn more here: www.gov.uk/register-a-company-online.

Money Matters:

Looking After Your Bottom Line

Funding

Of course, sooner or later money comes into it. Setting up your own enterprise costs money. But if you haven’t got the backing in place, there are some funding options available to you. Companies like startuploans.co.uk specialise in funding for new businesses offering something a little different.

You can also try crowdfunding, which works on the principle of many people making small investments in return for shares and future rewards.

Insurance

Being in the trades, you should probably already know the importance of insurance. When it’s your own company, this becomes even more important, as not having it can be the difference between success and failure.Find out what you need and where to get it here: startups.co.uk/ starting-a-business-fromhome- what-insurance-do-you-need/

Expenses

If you’re basing the business from home, you may need to inform your mortgage lender or landlord. But remember that there are tax benefits to having a home office, meaning you can claim back a portion of your heating, power and expenses when filing your taxes. Find out more here: https://www.planningportal.gov.uk/permission/ commonprojects/workingfromhome/

Accounts

You’ll also need to think about how you’re going to manage your finances as you go forward. The ICAEW’s Business Advice Services offers a free consultation with a chartered accountant: https://find.icaew.com/pages/bas. Or you can find your own using recommendations from friends and colleagues. Having an accountant take care of your finances could save you valuable time and plenty of headaches

Regulatory bodies: Doing it by the book

Regulatory bodies are organisations set up by the government with the responsibility of monitoring and controlling various industries and trades, in the interest of protecting consumer rights.

There are bodies for almost every trade you can think of (including the Association of Blind Piano Tuners) and being familiar with how they work and how to get in touch may be essential at many points in your career.

These regulatory bodies oversee standards, practices and working regulations for your particular trade. Fall foul of them at your peril.

You can find out more at:

https://www.britishservices.co.uk/associations.htm#listings

Building Blocks of Success: How to Find a Materials Supplier

The raw materials for your success are a good business plan, organisation and hard work. But the actual physical raw materials for doing the job need to come from a materials supplier.

The less you pay for them, the more profit you can make.

But of course you need to be constantly aware that you are

getting good quality. Go too cheap and the quality of your work will suffer. Value is the key to good business.

Buying in bulk from wholesalers is a good idea but you will also need to consider storage costs.

You can find a list of wholesalers here: https://www.thewholesaler.co.uk/

File it away: Admin Issues

Even if you’re working in hands-on industries like plumbing and carpentry, there is a certain amount of admin that comes with running any business. In order to stay on top of it, you need to:

|

|

|

|

Do your filing as and when little and often is the key |

Develop good systems it’ll save time when looking for paperwork later |

use technology hand written notes and scribbles you can’t read are a thing of the past |

|

|

|

There are various online tools and programmes you can use to help you with invoicing and quoting. |

Check out www.yourtradebase.com if you want to save hours on your paperwork, stay organised and win more work. |

The Next Step: How to Recruit Good People

Once you’re up and running and the work starts flowing in, the next step will be recruiting people to work for you. This is as important to your business as a business plan, initial capital and your determination.

Get the right people and you can make your business. Get the wrong ones and you could break it.

You can use online job platforms to find staff, including the Government’s Jobmatch platform: www.gov.uk/advertise-job. Or you can advertise on online sites like www.gumtree.com.

The best way is to ask around family and friends, as at least that way you can get reliable references beforehand.

Of course, having staff comes with certain responsibilities, which it will be your duty to know. You must register as an employer with HMRC. There’s a full list of obligations to be found here: www.gov.uk/employing-staff

Innovation

You’ve got customers, good staff and you’re even making a tidy profit. It’s all going in the right direction. So what can possibly go wrong?

Well, fail to adapt, innovate and stay ahead of the game and you’ll soon find out. All great businesses are constantly pushing in new directions. After Apple made the iPod and sold a gazillion, they didn’t just sit around, patting themselves on the back thinking about how successful they were. They started designing the iPod touch, the iPhone, theiPad and sold gazillions more of them.

Find out from your customers what it is they want in terms of service and create new ways of providing it. Look into expanding, new premises, updated websites, rebranding, new technologies and try to stay one step ahead of your competition.

Find office space here:

https://www.searchofficespace.com

Learn more about online marketing here:

Simply Business Knowledge Centre, Guardian Small Business Network

and the startups.co.uk site.

So there you have it, a comprehensive look at everything you need to know and think about before you set up your new business.

The market is crowded and it’s not always easy. Many start ups fail to prepare, and in doing so prepare to fail. Follow the above guide and you’ll be covering all your bases, giving yourself the best chance of success. Then you’ll be well on your way to living the dream and being in charge of your own destiny.

How to Recruit Trades People

Your own blood, sweat and tears, you can’t do it all by yourself. Growth is inevitably followed by the need to recruit, and you have to be able to trust the people that work for you.

Your staff are the customer-facing part of your business, and how they perform, behave and work is how you will be perceived in the wider world. Get the right team and the business will go from strength to strength. Recruit poorly and you’ll be fighting an uphill battle.

In this guide we’ll cover everything you need to know about recruiting staff, including:

|

|

|

|

What to look for in staff |

What qualifications? |

Where to recruit |

How to interview |

|---|---|---|---|

|

qualities for good |

why bits of paper |

the best places |

what you really |

|

|

|

|

Getting references |

Your legal responsibilities |

Tax and benefits |

Training |

|---|---|---|---|

|

a touch of the personal |

how to make it all legal |

the financial side of taking on staff |

how training improves your workforce |

The Perfect Employee: What To Look For in New Recruits

However, it’s key that you employ the right kind of person for this to work. Recruiting staff who understand how the company works, its philosophy and who share the ethics and values is the best way to create a core team.As we’ve stressed above, you can’t underestimate the importance of good staff. You can’t be a one man band and do everything yourself, but the way you run the company and principles you instil in your staff can have an effect. Set an example and your staff will follow your lead.

According to Forbes Magazine, often known as the ‘Bible of Capitalism’, employees should all possess the seven Cs. These are:

|

|

|

|---|---|---|

|

Character |

Culture |

Compensation |

|

are they the kind of person you can work with? |

do they fit with the values of your company? |

are you sure they’re happy with the terms of |

|

You can read the whole Forbes article here. |

The Right Bits of Paper: Qualifications Matter

If you look at the competency criteria from the above list, you may wonder how it is possible to know if a potential employee has the right skills to do the job. The only sure-fire way of knowing is if they have the right qualifications.

Are they able to prove they have the necessary skill set through producing the relevant qualifications? In the UK there are a number of core trade qualifications that show employees have the required skills.

|

National Vocational Qualifications can be achieved in a variety of trade skills, including electrics, plumbing, construction and more. For a full list of available courses and further details, visit: https://www.nidirect.gov.uk/nvqs |

|

For more information about the qualifications offered by City & Guilds, a global leader in skills development, you can learn more at: https://www.cityandguilds.com/ |

|

Apprenticeships can be offered, meaning you take on staff and train them on the job, while they are assessed on site by the relevant authorities. It’s a great way to invest in people and train staff in the way you want them to work but does require time and effort. |

Discovering Gold: Where to Recruit

Now you know what to look for, you just need to know where to find it. This is the tricky part but there are plenty of places you can go to source potential staff.

|

Ask about – friends, family and colleagues may know |

|

You could use professional recruiters but these are |

|

Go online – advertise on sites such as |

|

Centres of education – as we mentioned above, |

Ask the Right Questions: What to ask at the Interview

|

Bizarrely, conducting an interview can be just as stressful as being on the receiving end. If you’ve no formal training in interviewing staff, it can be hard to know the right questions to ask |

|

Use the time to try and get to know the person, and create an atmosphere where they feel comfortable, as you’re much more likely to get a glimpse of the real potential. They probably shouldn’t but appearances matter, as do first impressions.

There are certain questions you can ask which can elicit very revealing answers. These include:

|

For a full list of pertinent questions to ask, check out this Monster.com blog. |

Get a refeeree: Why a personal endorsement matters

|

If you need any further convincing, read this article on smallbusiness.co.uk. |

Keep it legal: Your responsibilities as an employer

It’s not quite as simple as placing an advert, hiring an employee and getting the job done. There are all sorts of legal requirements in place to protect both you and your staff. Here’s what you need to know.

Tax and benefits: Making sure everyone gets what they’re owed

As we’ve touched on above, you need to register with HMRC to make sure you and your staff are paying the relevant income taxes. This is your responsibility as an employer and you could face fines if you’re not adhering to the law.

However, there are also some tax expenses in place for those who employ staff. This often includes:

|

|

|

|

Company Cars |

Health Insurance |

|

|

|

|

Travel |

Childcare |

|

Discover more about your responsibilities at |

The success train: Why training really matters

Give your staff the opportunity to learn and they will be happier in the workplace. Studies have shown that a content workforce can be up to 20% more productive than the base rate. Try to make improvements like this in other areas and you’ll see what a big difference this can make.

Once you’ve found the right staff team or employees, you need to think about training. Not only does this create a better staff team, it shows that you value their development and future with the company. Better trained staff are more likely to stay longer, and reduced turnover improves consistency and keeps costs down.

|

There’s more information about staff training at |

Recruitment doesn’t have to be difficult or stressful and the right staff team is out there, it’s all a question of tapping into this resource. Follow the advice of the above guide, click on the links for more detailed information, and you can find out everything you need to know about the recruitment process.

The growth of your company depends on your ability to recruit the best people, so it’s really important stuff to know.

Infographic: How to turn a quote into business

7 November 2015

Infographic: How To Turn A Quote Into Business

10 tasks that are not helping your business

30 October 2015

10 tasks you spend too much time on which aren’t growing your business

Starting a business is never easy at the best of times. The odds are stacked against you so it takes good strategy, planning and dedication to make it work. In those precarious first few years, you have to put your heart and soul into the company, and very often you can’t afford to waste a single minute.

Which is why it is so frustrating when you have to spend time on the niggly but necessary little jobs just to keep things ticking along. Here’s our list of 10 jobs that you could really rather do without – the jobs that take up precious time when you should be focusing on growth.

- Maintenance

Painting and decorating, odd jobs, replacing light bulbs, all these little jobs you need to do to keep your workplace in good order all take up valuable time. Is it possible and cost efficient to employ a handy man? Or maybe you should look into serviced offices.

- Emails

Communication is the lifeblood of business but spending an hour or two each morning just wading through emails before work really starts east up productive time. Better filters and prioritising is the key.

- Taxes

They have to be done but you need a degree in accountancy to navigate the details of the HMRC tax system. So why not get someone with a degree in accountancy to do it for you?

- Accounts

For the same reasons as above, doing your own accounts can take hours or even days, when a pro could do it in no time for a small fee.

- Paperwork and admin

It’s estimated that 51% of small businesses spend more than a day a week just dealing with paperwork and admin. It’s also true that around half of all small business owners worry about admin – which eats up more valuable time.

- Quoting and invoicing

Quoting for new work and invoicing for jobs already completed is vital for any small business. However, it can take too much time writing up quotes from scratch and remembering exactly what it is you’re invoicing for. With quoting and invoicing software from Your Trade Base, you can significantly reduce the time spent doing it.

- Cleaning

Even small offices need cleaning and tidying, especially if they are customer facing. It’s all about creating good impressions. Paying a cleaner a few hours a week won’t break the bank and will free up some time to focus on the business.

- Endless meetings

It’s important to all be pulling in the right direction, which is why staff meetings are invaluable. But they do have a tendency to drag on. Restrict meetings to 30 minutes and have a strict agenda planned beforehand.

- Take a break

It’s all too easy to work through lunch, or grab a quick sandwich at your desk. It might seem like time saved but believe it or not, not taking the time to break is actually counterproductive. You need some time each day to let your mind refocus, you’ll be far more productive after a lunch hour.

- Over planning

As we mentioned at the start, it’s imperative that you plan well but it is possible to spend far too much time planning. If you’re spending hours each week creating templates, planning documents, and analysing information, then you’re not focusing your attention on growth. Learn when enough is enough. Sometime action is required.

How motivated are you to grow your business?

28 October 2015

How to keep yourself motivated and focused on business growth

Sometimes success is a double edge sword. Achieving your goals can be the most rewarding part of business, but equally, if you don’t get there as soon as you would have liked, it can be disheartening. This is one of the key areas of business that affect small businesses. If the company is not growing according to plan, it can be hard to stay motivated.

Plus, there are numerous distractions that can get in the way, taking time away from what should always be your number one goal – business growth.

Keeping your eye on the ball: Avoiding distractions

Admin and paperwork – This is one of the main hurdles to overcome for any small business. It’s estimated that the majority of small businesses spend around an hour each week just taking care of the paperwork. That’s 52 hours a year that you could be spending on hitting your targets. Yet the quotes, invoices, payroll and accounts all need to be taken care of for the business to function.

There are online admin services that can help, such as YourTradebase, who offer quoting programmes and invoice templates that help you get paperwork off your desk as soon as possible.

Meetings – All companies need to have a clear and defined direction, which is why team meeting are always important. But they do have a tendency to drag on, unless they are properly martialed. Unless there are exceptional circumstances, most meetings should take no more than half an hour, with clearly defined agendas.

Extracurricular activities – Business seminars, trade fairs, networking – these are all important parts of business but it’s all too easy to spend a little too much time away from the core business. Learn, meet and network but make sure you’re putting these new skills into practice

You can’t do it all yourself: Learn how to delegate

It’s all to easy to try and do it all yourself. One of the major stumbling blocks for small business owners is learning how to delegate. It’s been shown that most managers can unload up to 20% of their workload without there being a detrimental effect on other staff and productivity.

Train and trust your staff, let them take care of some of the everyday chores and running of the business, which leaves you free to focus on driving the business forward.

Why a strategy works

It’s crucial that you never lose sight of why you’re in business. To do this, you should always develop a business plan and strategy for achieving that from the outset.

Frame it, put it on a wall and constantly refer to it. Outline where you want to be in six months, a year, five years – and then assess where you are at these landmarks. A business with a good idea but no plan is bound to drift, and that spells disaster.

Stay focused, stay on plan and keep pushing to hit your targets.

7 hacks for saving time when growing your business

27 October 2015

Small businesses face difficult odds in competitive market places. So, any advantage you can give yourself will help you survive and thrive. Growth hacks are inventive and innovative short cuts that let small businesses hurdle obstacles that can slow down progress, reaching the next business goal sooner than expected.

Here’s a run down of seven of the best small business growth hacks that could give you the edge.

- Ride someone else’s train

When Air BnB started they wanted to try and leverage Craigslist user base. They included an option that allowed posters to advertise on Craigslist, which of course would have a link back to Air BnB, quickly growing the company faster than any of their rivals.

Do the same by identifying a customer base you want to attract and find a way of redirecting them to you.

- Two-way incentives

Companies like Uber have grown by using crowdfunding platforms and offering investors an incentive to invest. Offer investors a perk to become part of your company above and beyond the normal return and they can be essential in advertising your business and spreading the word.

- Admin tech shortcuts

Quoting, invoicing and admin eats up huge amounts of valuable time in most small businesses. Research indicates that many SMEs spend on average one day a week taking care of admin. By using quoting and invoicing software, you can cut down this time and spend it in a more productive way.

- Recruit smarter

Finding the right staff is make or break for small businesses. Be clever about recruiting, targeting the kind of people you want to work for you. Why wait for the right staff to come to you when you can appeal directly to them? Think business schools and tech colleges and go directly to the source of talent.

- Market smarter

There are all sorts of marketing hacks you can use – from online questionnaires to invite only websites. They have all been used to great effect, and with the right tweaking, could be used to bring customers to your website in their droves.

- Social media

Don’t hate it, embrace it. Whether you like it or not, social media is as important for your business as a phone number. Be active, visible, funny, whatever it takes to get noticed. Target forums, like pages, joins discussions – just get your name out there.

- The guest blogger

Invite guest bloggers to create content for your company, who may happen to have a big following. This creates interest in your brand and helps to spread the word to new markets. The same works for you guest blogging on other popular sites.

Growth hacking is the perfect combination of tech knowledge and innovation, as well as key time saving devices. Think smart, outside the box, and you could skip past several stages of slow progress to achieve real growth quickly.

How to decide on a price for your services

23 October 2015

How to make sure your trade business doesn’t compete on price

Running a successful business isn’t always about matching your competitor’s price. Being the cheapest can work, just look at Ryanair, but then British Airways is still one of the biggest companies in the world. In every market place there are room for budget and high end competitors.

A successful business is as much about branding, good customer service and reputation as it is about price. Psychological studies consistently show that people link higher prices to better quality, which is as big a draw as affordability. That’s how luxury jewellers like Cartier sell so many watches.

Why expensive beer should be your role model

Back in the 1990s, Stella Artois entered a crowded market place with an advertising campaign that emphasised how expensive it was – against all the thinking at the time. Various French farm labourers would do whatever they could to stump up the cash for a glass of beer. In doing so, they attached a premium tag to their label that set it apart from all the other beers competing on a purely value basis. The result? Stella quickly became the biggest selling beer in the UK and the marketing rulebook was thrown out the window.

How to calculate your worth

So, before automatically matching your competitors on price, think about your true price. Calculate your hourly rate based on what you want to earn and stick to it. You can also establish this by asking your customers what they think is a fair price and analysing the competition.

In order to increase your true price, you need to think about ways of enhancing your service and standing out so that being cheap isn’t your USP. Here are some ways to achieve this:

- Improve customer service by going that extra mile

- Think about working more flexible hours to suit customers

- Work quicker and work better (there is no upper price limit on quality)

- Additional extras like online booking and call backs

Avoid the downward pricing spiral

Competing on price works for some. People pick up work by doing it for less but it’s rarely a long-term solution. Competing on price can often be a slippery slope, with companies desperate to undercut each other and eventually working at a loss. Standards are then forced down by a lack of time to complete jobs and the work dries up as word of mouth works against you.

Value your work and don’t do it for less. In the end, if you’re good enough to deserve the money, customers will soon work it out. And after all, they’re always right.