So, you’ve come up with a good idea for a business, done your research and identified a gap in the market where you can be successful. That’s the hard part done right? Wrong. In fact, developing a model is just the beginning of the process. The hard work starts with creating a business plan, which can help to turn a good idea into a successful business.

What is a business plan?

This is a written document that describes your business. It will cover everything from your core objectives and sales strategies to financial forecasts and market research. It’s not something you can scribble down on the back of a napkin, it involves some hard work in order for you to be taken seriously. A thorough business plan will also help you to:

- Clarify your business ideas

- Identify potential problems within the model

- Lay out clear goals and objectives

- Track progress as you develop

If you’re going to need investment or a loan in the future, it will be an essential part of securing either. Plus, it’s a handy way of convincing customers and clients that you’re serious.

How to write a business plan

Before you start, spend some time considering:

- What information you need to include

- How you are going to present this information

If you are clear about these two points, writing your plan will be significantly easier and you will be less likely to have to change your plan during the process.

The template

Executive Summary

A business plan starts with an executive summary. This is the last part of the plan to be written but goes on the first page. The idea is to outline your business proposal and highlight the key areas of your model, including:

- Your product and its benefits

- Your market

- Your structure

- Your experience or track record

- Financial projections

- Funding requirements

Remember that some readers may never get further than this section of your plan so make it eye catching, captivating and accurate.

The business

You need to give some background to the business. Explain where the idea came from, your inspiration, your experience, any work carried out to date and details about the structure or people involved at this stage.

Explain clearly what your product is, how it differs from others and where your potential market is found. You need to be clear about who will buy your product/use your services and what the benefits are for customers. You should also indicate how you would be able to adapt in the future should conditions change.

Indicating a detailed knowledge of the industry in which you work is essential. Being able to demonstrate this understanding – by explaining regulation, changes in technology etc. – will reassure potential investors.

Markets and competitors

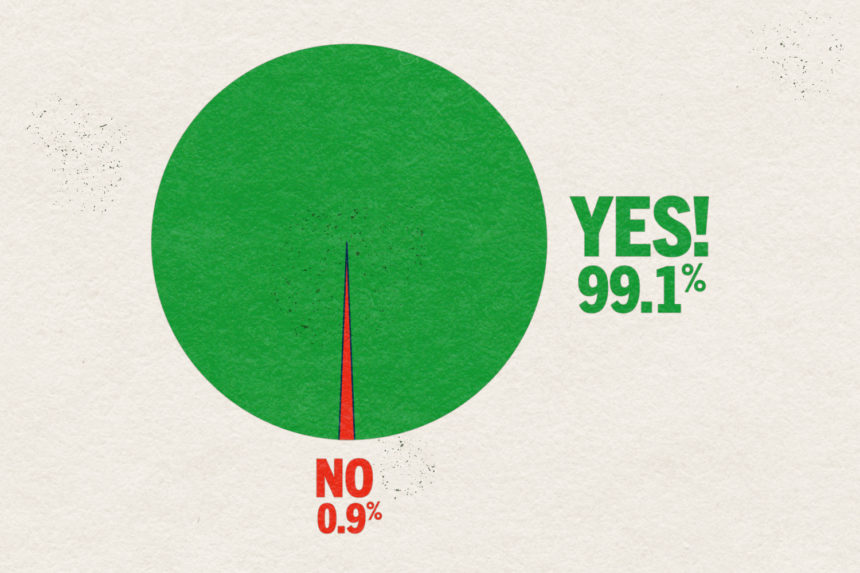

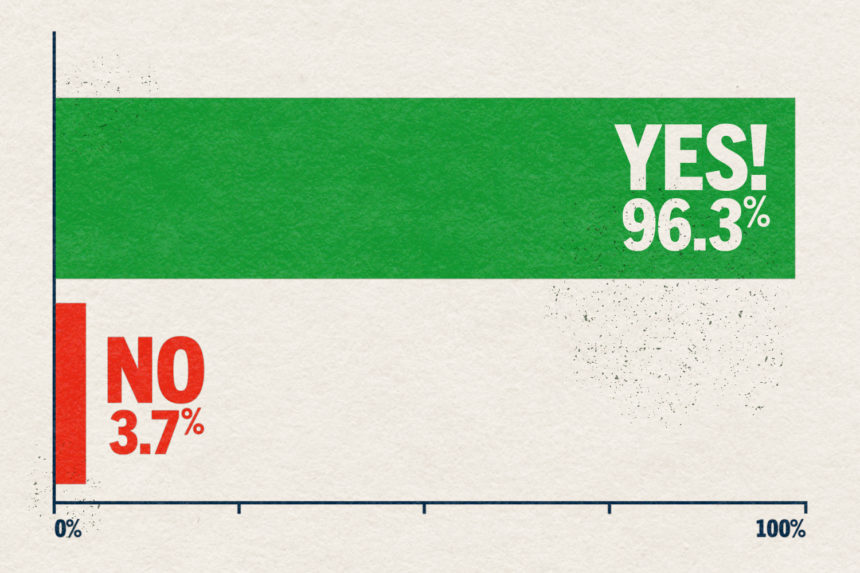

No matter how good your product, service or idea, if the market doesn’t exist then it wont succeed. Do you research and demonstrate that you have focused on the right segments of the market you aim to target. Indicate where the customer base is, whether it’s growing or declining and outline factors that affect it. Illustrate important trends visually and how these may be influenced.

Know your customers. Outline their key characteristics and demographics i.e. age, sex, income, aspirations. If you have existing customers of clients then use this information to back up your findings. Primary research is invaluable for building trust and authenticity.

Knowledge of the competition should include:

- Who they are

- Where do they operate?

- What do they charge?

- Advantages and drawbacks of their products

- Differences in operations

Sales and marketing

How will you position your product and meet your customers need? What will you charge? What will be your minimum order figures?

Most importantly, how do you plan to sell to customers?

- Phone

- Online

- Face-to-face

- Through an agent

Include details of how long the sales process will take and how you will build up a contacts base for future business. Many new businesses underestimate this area and don’t last as a result.

You should also have a plan to promote or advertise, which should be detailed and fully costed.

Operations

Here you need to make clear how the business will work on a day-to-day basis. What will the internal structure be? How will the business be managed and what experience will you have in the team?

You also need to think about what facilities and equipment you will need to run the business, how many staff you will require and where the business will be based. Demonstrate research and costings for location, required space and any machinery that you will need.

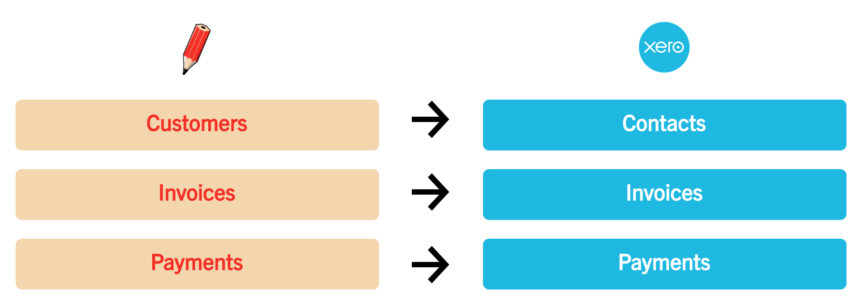

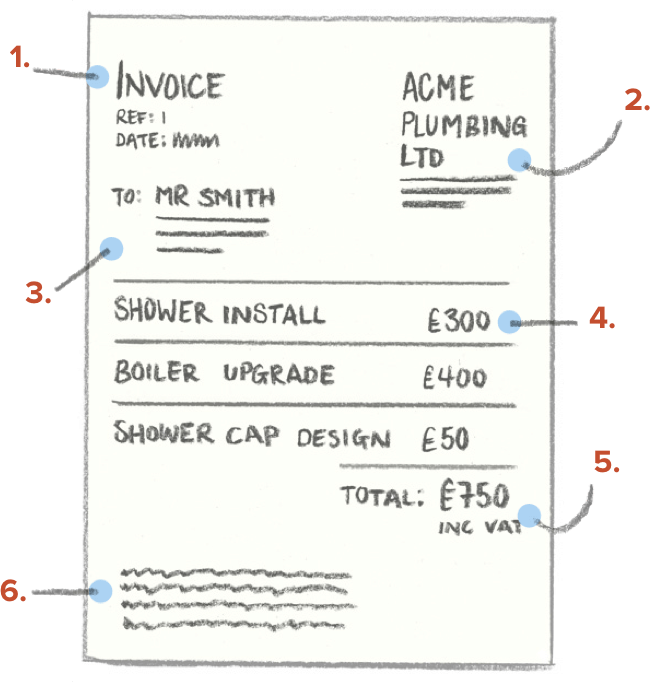

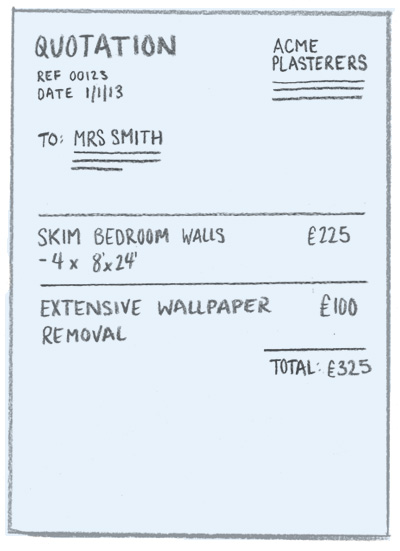

Payment is another key issue that needs to be addressed.

- How will you be collecting money from clients?

- Will you accept card payments or simply cash?

- Will you offer customers financing options?

- How will staff and invoices be paid?

Financial forecasts

In many ways, this is the most important part of your business plan. Potential investors need to know how much money the business is going to turnover. Of course, with any forecast there is an element of doubt and insecurity. However, you can’t just pluck these figures out of thin air.

Figures should be realistic and broken down into component parts. Show your cashflow forecast – how much money will be going into and out of your account. This is determined by levels and timing of sales, wage payments, bills and other factors. Remember that it is very easy for experienced investors or banks to see through poorly collated financial data. Never try to pull the wool over their eyes. It won’t work.

Outline your profit and loss forecast, giving a clear indication of how the business will move forward both initially and in the coming years. Larger start ups will need to include projected balance sheets.

It’s worth remembering that these are just forecasts and are not set in stone. They should be accurate but are also subject to revision.

Financing the business

Utilising the above financial information, you should be able to clearly demonstrate how much investment or financing the business needs. You should also be able to indicate what kind of financing will best suit your needs and when this will be required – fixed interest loans, overdrafts etc.

Clear indication of how this money will be used, with detailed break downs of costings will reaffirm your point. Make sure this is comprehensive and don’t omit important details such as salaries, insurance, stock etc.

Risk assessment

Any business you start will be a considered risk. Banks and investors know this but they also need to see that you have considered where it could go wrong. Think about what might happen if your supply chain is interrupted or if a new competitor undercuts you.

For example, what happens if?

- Sales are lower than expected

- Interest rates go up

- Laws change

- You have staff shortages

You need to put contingencies in place for every eventuality.

Tips for creating your business plan

Not everyone has experience creating business plans and they can be daunting. However, they follow a fairly set formula and as long as you put the work in, do your research and don’t cut corners, they are fairly straightforward to create.

However, there are certain tips and factors that can improve your business plan and give it a better chance of impressing potential investors.

Keep it short

It might look like the above plan requires pages and pages of info but that’s not necessarily true. Keep information clear and concise. Most business plans are way too long and people can lose interest. As long as the data is accurate, well researched and can be understood easily, plans don’t have to be huge.

Make it look professional

Keep your plans neat and tidy. Use a uniform font, make sure it is thoroughly checked for mistakes and that it’s formatted well. Include a cover and a contents page – making sure pages are numbered correctly. You can even give it a title. A professional looking plan stands more chance of making a good impression.

Put it to the test

Read it. Read it again. Then leave it for a while. Then go back and read it once more. Does it all sound good to you? Does it give a clear indication of what you want to achieve?

Give it to friends, family and colleagues to look over and take their criticism on board. If they find certain parts of it confusing, chances are so will other people – and they know you best.

Your business plan should be the rock on which you build your success. It’s a formal record of the work you’ve put in to get the business off the ground. If it’s good, it can secure investment, outline your goals, point out possible mistakes in your thinking and help you identify areas you need to work on.

As your business grows, you can use your plan as a yardstick to measure growth and success. It can even help to realign your focus. In the future, you will hopefully be able to look back at your plan as the guidebook for your success.