Invoicing. It’s a hassle. But no matter what trade you’re in, it has to be done… but, what should you include when creating your invoice?

Here are our top tips on what you should include on your trade invoices.

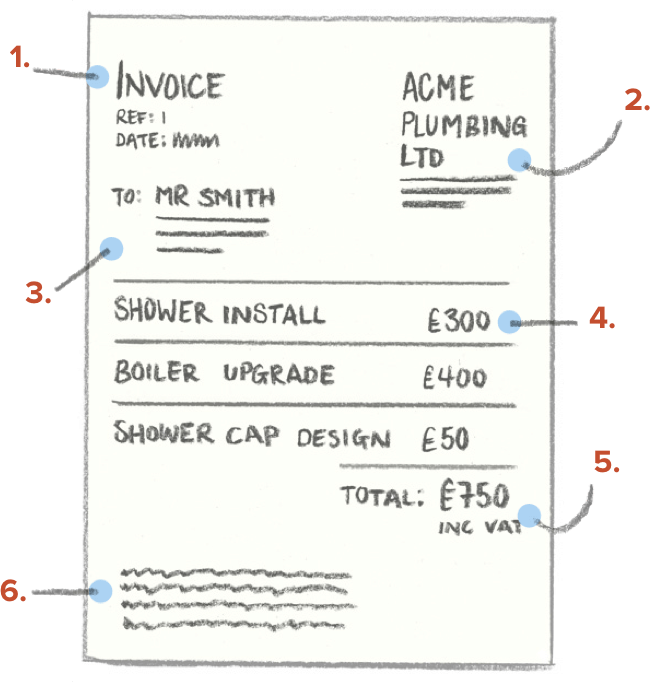

These are things you must include on your invoice:

-

- You must include the date for the invoice and a unique invoice number — These will help you at the end of the year with your tax return and if you ever need to find a particular invoice. These must follow on from one another (e.g. ABC1, ABC2, ABC3 etc…), and if one is spoilt or cancelled, it has to be kept as a record for HMRC.

-

- Your business name and address — this probably seems obvious, but you’d be surprised at how many tradesmen forget this.

-

- The name and address of the person you’re invoicing — again very obvious, but worth remembering.

-

- A list of products and services you provided — line by line and the cost of each of these. Not only is this a requirement, but it can help if your customer disputes the price, as they get all the information.

-

- Total amount of the invoice — because you need to show the price, right?

- Terms of payment for the invoice — for example if your customer pays in one lump sum, or week by week. This again is especially helpful if you have problems getting payments from customers.

These are things that we think you should include on your tradesman invoice:

- Company email address, everything is online these days, and it looks far more professional to have a dedicated email for your business.

- Your payment details, bank details/online payments etc… You might still deal with checks so this may not apply to you, but it can save a lot of doubling up if you provide the information straight away for customers.

- Due date of payment – again this can help with late payments and customers not knowing a payment schedule.

- Logo and presentation. So these aren’t technically things to include. But they are an important part of presentation for you and your business. And they also make it more likely (along with your good work of course) for customers to recommend you – as you look professional all round.

VAT registered? Here’s what you need to include:

- Your VAT number

- If you’re a limited registered company, you MUST include your company name

- The time of supply – also known as tax point – if this is different from the invoice date.

- The amount of VAT on each line of the invoice and the VAT rate charge for each

– or –

- The total amount of VAT on the invoice and the rate of VAT applied to all items.

Still awake? Excellent! Then you’re on the right track to cutting the time and frustration when you’re creating invoices! Find out more about YourTradebase Invoicing Software