You do a great job, have a happy customer, then wait to be paid… then you wait some more… more waiting and still no money.

Waiting to get paid doesn’t help you or your business. Here’s how small changes can help you start getting paid on time.

There’s a business mantra that “Cash is King“. Looking after your businesses cash flow is all-important to the health and success of your business.

But what happens if you end up waiting weeks to get paid the money for jobs you’ve already completed (and probably paid out for materials and labour for)?

Here’s why not getting paid on time hurts you and your business – and how to make sure you do get paid in good time.

Are you getting paid on time?

A recent survey of 10,000 tradespeople shows that the #1 tradesman’s frustration is not getting paid on time. (Source: Ironmongery direct survey)

It’s also been estimated that UK tradespeople could be owed up to £2.5 billion each year by late-paying customers, according to this report by WorldPay.

According to that report, builders (88% suffer late payments) and plumbers (90%) are the worst affected tradespeople.

With such a large number of tradespeople having to wait for such large amounts of money, it’s no wonder late payments top the list of tradesmen’s frustrations.

It’s likely to be very damaging to morale, lifestyle and business cash flow, too.

Why getting paid on time is important to your business

Other than late payment from customers being frustrating, there are other ways it impacts you and your business:

- Late payment affects cash flow. We’ve already mentioned the importance of cash flow. It’s imperative that cash flows through your business to allow day to day operations to continue unaffected. Late payments make this difficult.

- Time spent chasing payments could be spent elsewhere. Phone calls, visits, letters. Even relatively small actions to chase late payments eat into your valuable time and add up to time you could – and should – be spending on other things.

- Your salary suffers. If your salary is directly linked to the cash your business generates, then going without personally after completing work isn’t fair or fun.

- Worrying about cash is stressful. Just like the time you spend chasing late paying customers, you’re also wasting a whole lot of energy too. That’s energy that is better spent on growing your business.

So, we know that late payment is a big issue for tradespeople and their businesses, but what steps can be taken to try and avoid – or at least minimise – late payments…

7 Tips for getting paid on time

Here are our 7 top tips to help tradespeople get paid on time from their customers:

1. Invoice promptly

Sounds obvious, but if you’re expecting to be paid, your customer probably expects to know about it!

Make sure you have a system in place to allow you to send invoices quickly and easily when you need to.

Outlining the exact work you’re invoicing for will help make sure there’s no room for debates about what the invoice covers – which could normally lead to time delays.

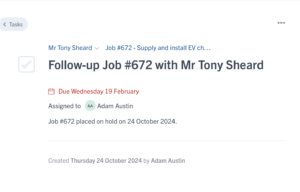

If you’ve set up staged payments on a larger project, then set yourself reminders (using your calendar or invoicing system) of what’s due and when.

Even better, create all the invoices for staged payments at the start of a job, with their expected due dates and make sure you’re able to receive notifications from your tradesmen invoicing software when those invoices are due to be sent.

Sending invoices on time should minimise waiting time for payment, and shows your customer you expect to be paid! Tweet this

2. Set a due date clearly on your invoice

As well as presenting an invoice with a good level of detail, be sure to clearly state on your invoice when the payment is due. Do you offer 7 days payment terms? 14 or 30 days? Or do you expect immediate payment?

Delayed payments might arise from customers not realising that payments are due within a set time period, so try to avoid this situation.

It’s also worth including on your invoice the methods available for payment to be made.

Make it clear to your customer when and how to make payments to you if you want to be paid on time. Tweet this

3. Set clear payment terms when quoting

As we stated above, your customer expectations can be a big factor in late payments.

If customers aren’t entirely clear on what your expectations are, they could think delaying a payment by a few days or weeks is no big problem.

To avoid this, make sure that payment terms are part of your quoting process.

Be clear on what payments you expect, when they need to be made and by what method within your quotes. When your customer accepts the quote, they’re also entering into an agreement on their side to meet the required payments on time.

Setting a clear payment schedule when quoting for work helps avoid potential payment issues in the future. Tweet this

4. Be clear on amounts from the start

Gillian Guy, the chief executive of Citizens Advice:

“Disputes often arise when there is a lack of clarity around how fees have been calculated and who pays for materials or travel costs. To try to avoid this, it is really important to agree what you are paying for in advance, and get it down in writing so that you have the evidence if there is any disagreement later on.”

Make sure a ‘lack of clarity’ doesn’t lead to late payments from your customers.

Be clear on all costs when quoting for new work, and also be clear on any estimated costs, or possibilities where extra costs will be incurred.

Are you charging for travel time? Make sure your quote always clearly outlines exactly what is – and isn’t – covered in the costs.

Be clear on what you’re charging for what work – and make sure it’s in writing – to avoid late paying customers. Tweet this

5. Keep your finger on the pulse of your business

You should know how your business is performing and be able to answer some common questions if you want to minimise the impact of late payments.

What payments are due to be invoiced this week?

What payments are now overdue, and by how long?

What payments have you received this week?

By knowing the state and health of your business, you’re much better placed to avoid the issues (and stresses) that late payments might bring.

Make sure you’re invoicing solution gives you a clear idea of what’s what in your business at a glance.

Don’t leave it until it’s too late to get a handle on your businesses cash-flow.

To minimise the impact of late payments that might arise, it’s vitally important that you know your business. Tweet this

6. Define a simple process for chasing late payments

If you accept that late payments are going to happen from time to time, then being prepared to deal with them will save you time when it does happen.

A simple process for dealing with late payers could include:

- Draft a letter or email that you can re-use when you need to chase late payments.

- Have a system that alerts you when payments are overdue.

- Set a reminder of when to follow-up a letter or email with a phone call.

- Decide what – if any – your escalation procedure is going to be.

Be prepared to deal with late paying customers professionally and reduce your stress and wasted energy! Tweet this

7. Deliver great work to agreed works details

Of course, the best way to avoid late payment is to not give your customers any excuses by delivering great quality work!

If you’re on time and deliver agreed works to a great quality, your customers are going to have difficulty in finding a reason to delay payment.

Aiming to make your customers ecstatically happy with the work you deliver is a great way to avoid late payments, and makes great business sense, too!

It could also mean getting your work ‘signed-off’ at each stage of the job. By making sure your customer agrees the work is completed in ‘stages’, there’s much less room for complaints or upset leading to delayed payments when the job is finished.

Agreeing scope of work in advance and having the customer sign-off at milestones can help avoid late payments. Tweet this

My customer is refusing to pay… what next?

If a late-payment is starting to look like a non-payment, things can get a little more serious.

Here are some resources that should lead you to some help and advice on what to do next:

- Government advice on dealing with non paying customers: https://www.gov.uk/invoicing-and-taking-payment-from-customers/payment-obligations

- Contact your local branch of citizens advice: https://www.citizensadvice.org.uk/

- Advice from Business Know How: https://www.businessknowhow.com/money/wontpay.htm

- Advice from lawdonut.co.uk: https://www.lawdonut.co.uk/blog/2013/04/when-customers-wont-pay

– – –